What are Current Cap Rates for Apartments. Value Add Acquisitions are priced at an all-time high averaging a 6 cap. Apartment cap rates 2012.

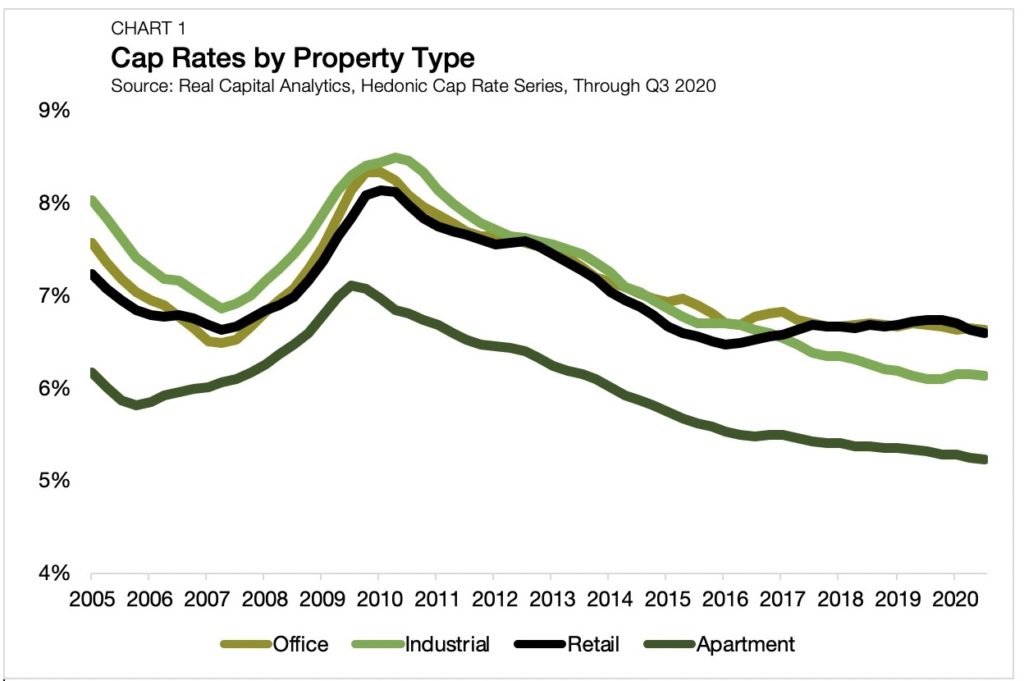

Apartment Cap Rates 2012, Cap rates under 4 Iu2019ll buy any multifamily product I can get my hands on Filename. LIHTC Property Performance Continues to Improve. The flight to high-quality assets has been especially evident in the apartment sector where mean cap rates have been falling since 3Q09 and now stand at 63 percent.

How Resilient Are Apartment Cap Rates In A Crisis Arbor Realty From arbor.com

How Resilient Are Apartment Cap Rates In A Crisis Arbor Realty From arbor.com

Over on the West Side properties are trading at 14x annual rent. A sampling of Q1 Canadian cap rates. 33600 97 33600 0097 346392. As Manhattan rents reach record heights investors are pushing prices of apartment buildings on the island into a new stratosphere and limiting returnsCiting Real.

Finance Cap Rates Construction Finance Affordable Housing LIHTC.

The cap rates quoted in the Colliers report reflect investor sentiment prior to the COVID-19 pandemic in March. So be wary of overpaying for a property that needs major repositioning or rehab. Yield for Apartment Building 82000 1250000 66 Yield for Office Building 66000 1250000 53 Price at which Apartment would provide same yield as Office 8200053 1547170 Implied capitalization rate for Apartment price that provides same yield as the Office building 1000001547170 64. What are Current Cap Rates for Apartments. Apartments Outlook 2012 Survey multifamily cap rates trending in 2012 for the most competitive markets. Apartments-Outlook-2012-Surveypdf - Read File Online - Report Abuse.

Read another article:

Source: crej.com

Source: crej.com

2012-2013 TAX RATES AND OTHER FEES Per 100 of assessed value REAL PROPERTY Assessment Cap Primary Residence Only STATE 0112 10 Filename. During this period and especially the later part of it the appropriate level of cap rates was widely discussed and debated amongst the new paradigm-real estate risk has been permanently re-priced and pricing bubble camps. Apartments sold for an average of 95700 per unit and capitalization rates dipped to 63. In many areas the price of apartments is now greater than it was during the peak of the mania in 2007 and surging higher at a relentless rate. Cap Rates Vs Interest Rates Should Anyone Really Care Colorado Real Estate Journal.

Source: arbor.com

Source: arbor.com

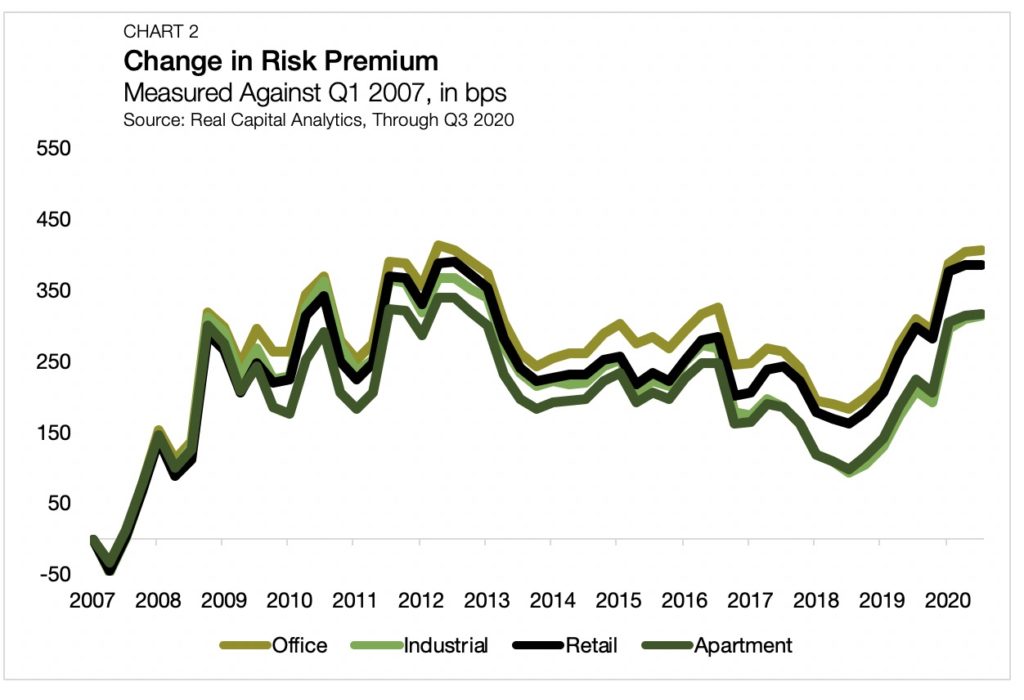

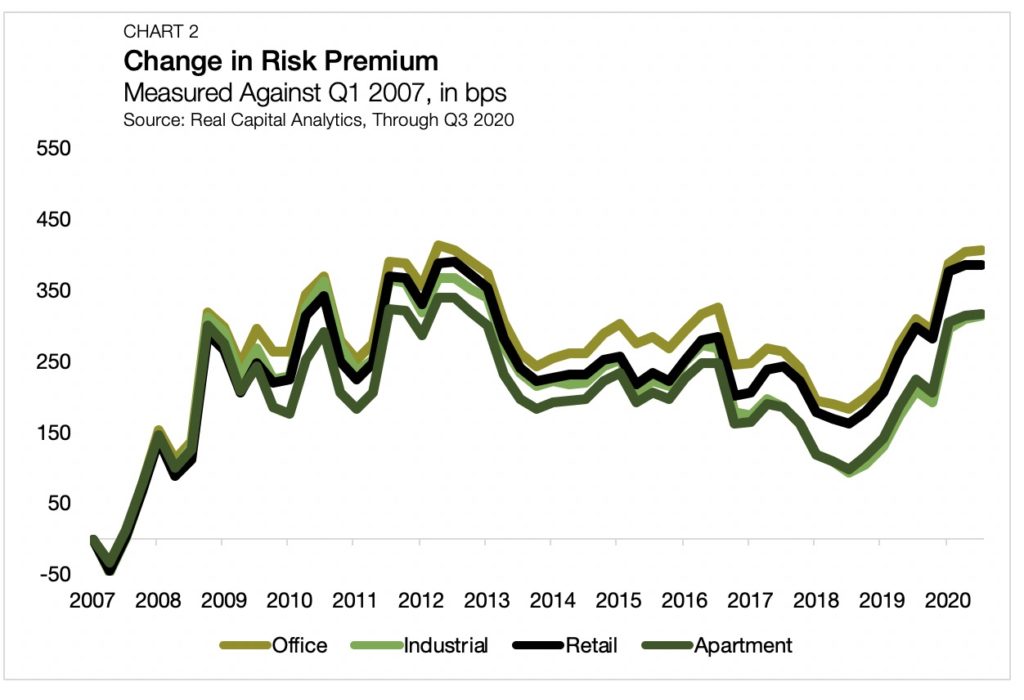

A sampling of Q1 Canadian cap rates. 2012-2013 TAX RATES AND OTHER FEES Per 100 of assessed value REAL PROPERTY Assessment Cap Primary Residence Only STATE 0112 10 Filename. Plus class B and C cap rates were 520 bps higher than the 10-year Treasury rate in 2Q12 compared with a 400 bps difference between class A and the 10-year Treasury. Thats a difference of 14950 month. How Resilient Are Apartment Cap Rates In A Crisis Arbor Realty.

Source: statista.com

Source: statista.com

Yield for Apartment Building 82000 1250000 66 Yield for Office Building 66000 1250000 53 Price at which Apartment would provide same yield as Office 8200053 1547170 Implied capitalization rate for Apartment price that provides same yield as the Office building 1000001547170 64. Over on the West Side properties are trading at 14x annual rent. The Santa Monica tenant is now in 2012 paying 133231. But how will demand for lower class multifamily properties in smaller markets affect the future of investment and development. Mortgage Rate Per Quarter In Europe 2012 2020 Statista.

Source: altusgroup.com

Source: altusgroup.com

During this period and especially the later part of it the appropriate level of cap rates was widely discussed and debated amongst the new paradigm-real estate risk has been permanently re-priced and pricing bubble camps. Thats a difference of 14950 month. Posted on July 07 2016. Apartments Outlook 2012 Survey multifamily cap rates trending in 2012 for the most competitive markets. Investors Show Strong Preference For Select Asset Classes And Are Optimistic For The Second Half Of 2021.

Source: arbor.com

Source: arbor.com

Yield is in the crosshairs. The sale of high-quality assets created a pricing disconnect between buyers and sellers. Downtown office class-A Vancouver 35 per cent to 450 per cent. Current Cap Rate for New York-Newark-Jersey City NY-NJ-PA. How Resilient Are Apartment Cap Rates In A Crisis Arbor Realty.

Source: nreionline.com

Source: nreionline.com

This is an average cap rate and needs to be adjusted. Each quarterly Survey issue contains. As Manhattan rents reach record heights investors are pushing prices of apartment buildings on the island into a new stratosphere and limiting returnsCiting Real. The Santa Monica tenant is now in 2012 paying 133231. Investors Pay Top Dollar Cap Rates Continue Falling National Real Estate Investor.

Source: es.pinterest.com

Source: es.pinterest.com

Apartment buildings in the United States currently sell for about a 7 cap rate on average and this average has fluctuated between 65 and 75 for the last ten years. A sampling of Q1 Canadian cap rates. Yield for Apartment Building 82000 1250000 66 Yield for Office Building 66000 1250000 53 Price at which Apartment would provide same yield as Office 8200053 1547170 Implied capitalization rate for Apartment price that provides same yield as the Office building 1000001547170 64. The statistic presents the commercial property capitalization rates in the United States as of April 2012 by type. Pin On For The Home.

Source: pinterest.com

Source: pinterest.com

Posted on December 16 2014. So be wary of overpaying for a property that needs major repositioning or rehab. Posted on July 07 2016. Since 2012 apartment cap rates have fallen precipitously with even greater drop-offs seen by trophy assets in major cities. Gold List 2012 The Platinum Circle Cape Town Hotels Hotel Interior Design Living Room Designs.

Source: tr.pinterest.com

Source: tr.pinterest.com

Not only did the average apartment cap rate decline in the quarter by 20 basis points to. Yield is in the crosshairs. The Santa Monica tenant is now in 2012 paying 133231. Current Cap Rate for New York-Newark-Jersey City NY-NJ-PA. Cap Rate Table 2012 By Region And Type Commercial Real Estate Commercial Real Estate.

Source: base.berkadia.com

Source: base.berkadia.com

33600 97 33600 0097 346392. There have been times when it was higheras recently as 2012 it was about 450 basis points. During this period and especially the later part of it the appropriate level of cap rates was widely discussed and debated amongst the new paradigm-real estate risk has been permanently re-priced and pricing bubble camps. The cap rates quoted in the Colliers report reflect investor sentiment prior to the COVID-19 pandemic in March. Berkadia A Retrospective Look At A Historic Cycle In Commercial Real Estate Berkadia.

Source: pinterest.com

Source: pinterest.com

Posted on December 08 2014. This is an average cap rate and needs to be adjusted. The PwC Real Estate Investor Survey is widely recognized as an authoritative source for capitalization and discount rates cash flow assumptions and actual criteria of active investors as well as property market information. Yield is in the crosshairs. Introductory Paragraph For Compare Contrast Essay In 2021 Writing A Research Proposal Essay Research Proposal.

Source: pinterest.com

Source: pinterest.com

Posted on December 16 2014. But back in 2006 there was only about a. This is an average cap rate and needs to be adjusted. Thats a difference of 14950 month. Thunder Dolphin Tokyo Dome City Japan Located At The Tokyo Dome City Attractions Amusement Park This Steel Coaster Is C Tokyo Dome Amusement Park Thunder.

Source: base.berkadia.com

Source: base.berkadia.com

Here are some of the Q1 2020 cap rates for select Canadian major markets and asset classes from low to high ranges. What are Current Cap Rates for Apartments. Since 2012 apartment cap rates have fallen precipitously with even greater drop-offs seen by trophy assets in major cities. Current Cap Rate for Boston-Cambridge-Newton MA-NH. Berkadia A Retrospective Look At A Historic Cycle In Commercial Real Estate Berkadia.

Source: pinterest.com

Source: pinterest.com

Over on the West Side properties are trading at 14x annual rent. Cap Rates for Multifamily Apartment properties are holding at a historical low for 2021- averaging a 5 cap or even lower for newer A and B Class and 534 for C Class. If the average growth rate in rents is 30 then the cap rate formula produces an average cap rate of 660 160 80 30 660. Not only did the average apartment cap rate decline in the quarter by 20 basis points to. Mike Viktor Viktor Edificio De Viviendas Cadix Antwerp 2012 Modellen.

Source: crej.com

Source: crej.com

Value Add Acquisitions are priced at an all-time high averaging a 6 cap. Five of the eight Class A transactions occurred in Johnson County solidifying the areas reputation as one of the most desirable in the Kansas City metropolitan area. The 2011 and 2012 nationwide median physical occupancy rate reach 97 percent a. Current Cap Rate for Boston-Cambridge-Newton MA-NH. Cap Rates Vs Interest Rates Should Anyone Really Care Colorado Real Estate Journal.