Many times these are also in up-and-coming areas. How to Make Amazing Returns on an Apartment Building. Average return on apartment building.

Average Return On Apartment Building, I even bought my first apartment building from a wholesaler and have a 43-unit under contract that was brought to me by an investor who is wholesaling the deal to me. Or 200 per month. And a small apartment investor will typically earn more money per unit each month when compared to larger apartment buildings.

Buying An Apartment Complex Is Easier Than You Think The Motley Fool From fool.com

Buying An Apartment Complex Is Easier Than You Think The Motley Fool From fool.com

Generally speaking you can expect between a 4-10 cap rate when you purchase an apartment. Conducts apartment related research encourages the exchange of strategic busi ness information and promotes the desirability of apartment living. Suppose that were utilizing a cap rate of 10. I even bought my first apartment building from a wholesaler and have a 43-unit under contract that was brought to me by an investor who is wholesaling the deal to me.

And a small apartment investor will typically earn more money per unit each month when compared to larger apartment buildings.

So the answer is yes it is possible and in this article Im going to outline how to do it. An investor can expect between high single-digit and low double-digit cash on cash return lets say 8 to 12. When it comes to how much money you can make from investing in apartment buildings it depends on how big on an investment you make. Pros of Investing in an Apartment Building. To calculate your after-debt return called a cash-on-cash return you divide that net cashflow by your down payment. Back in 1980 when cap rates were expected to be 15 percent or more this property might have appraised at 711033.

Read another article:

Source: medium.com

Source: medium.com

How to Make Amazing Returns on an Apartment Building. Now the value would be 2133100. Generally speaking you can expect between a 4-10 cap rate when you purchase an apartment. If you put 700000 down on that 24 million property you would owe 17. What Is The Lifespan Of An Apartment In India Is Investing In Older Apartment A Better Option Than Investing In A New Apartment By Mars Mount Medium.

Source: fixr.com

Source: fixr.com

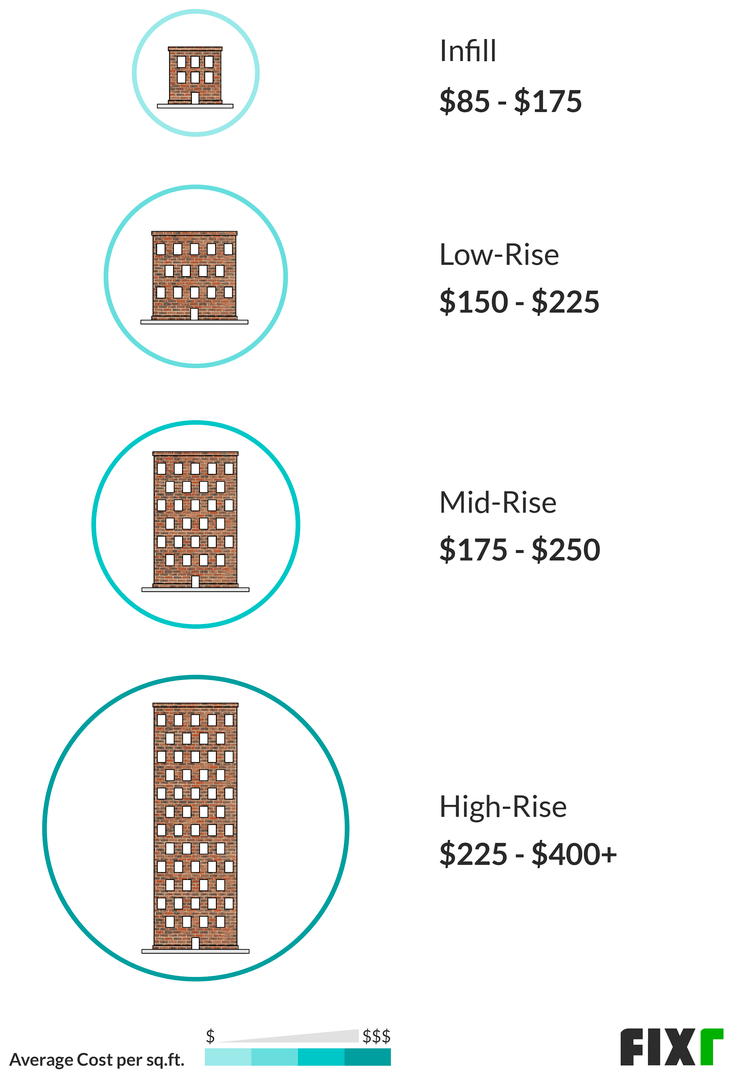

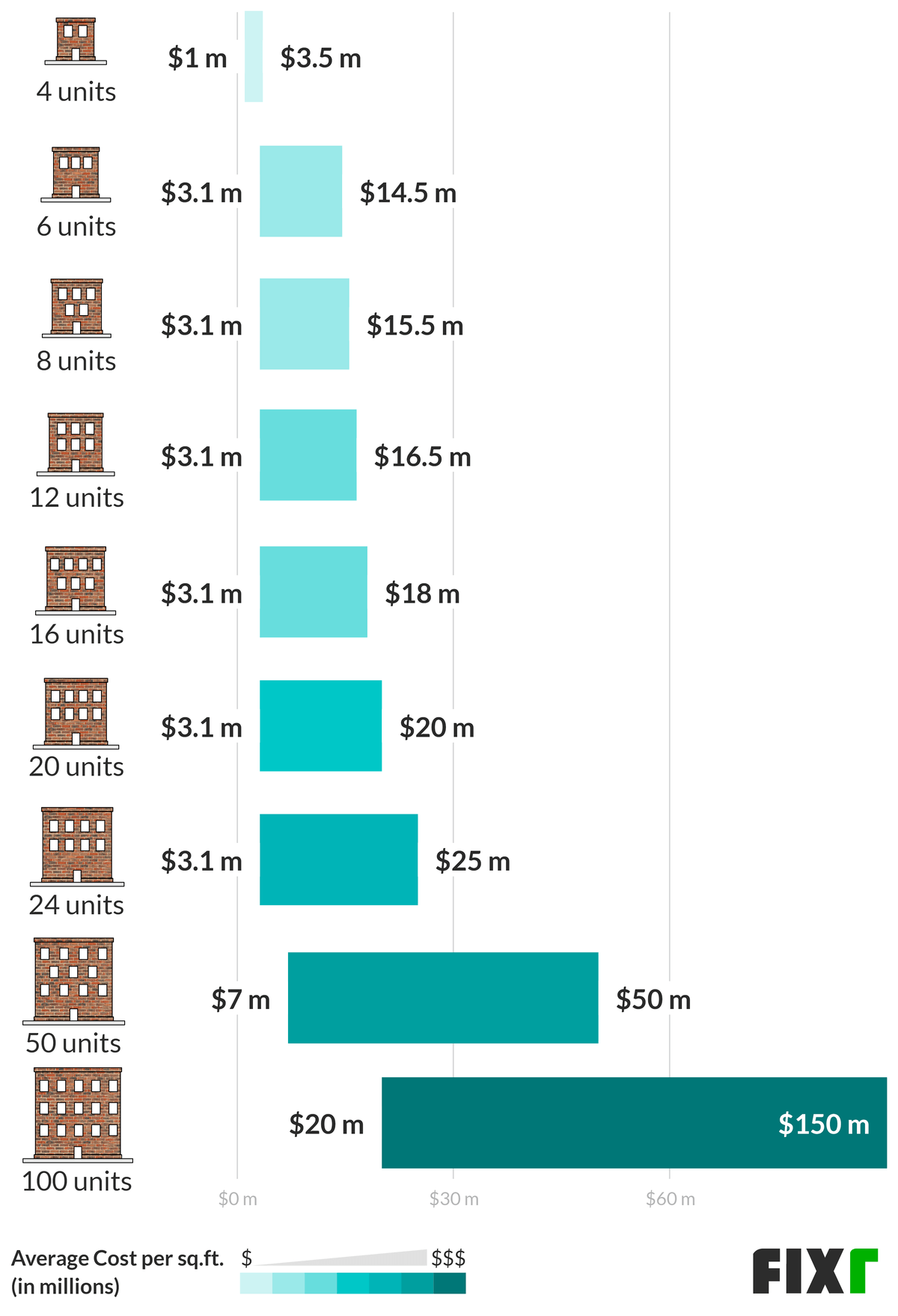

Or 200 per month. You will need to acquire the following 7 skills. I even bought my first apartment building from a wholesaler and have a 43-unit under contract that was brought to me by an investor who is wholesaling the deal to me. Conducts apartment related research encourages the exchange of strategic busi ness information and promotes the desirability of apartment living. 2021 Cost To Build An Apartment Apartment Building Construction Cost.

Source: fixr.com

Source: fixr.com

Determining the apartment buildings value. I even bought my first apartment building from a wholesaler and have a 43-unit under contract that was brought to me by an investor who is wholesaling the deal to me. Return on investment. This building profile is. 2021 Cost To Build An Apartment Apartment Building Construction Cost.

Source: expatica.com

Source: expatica.com

For example if maintenance property taxes mortgage costs and your down payment. If the preferred return is 8 and limited partners invested 1 million the annual preferred return is 80000 008 1000000. Pros of Investing in an Apartment Building. When it comes to how much money you can make from investing in apartment buildings it depends on how big on an investment you make. Renting In Germany A Guide For Homeseeking Expats Expatica.

If the preferred return is 8 and limited partners invested 1 million the annual preferred return is 80000 008 1000000. Generally the average rate of return on investment is anything above 15. The SP 500 Indexs average annual return over the past two decades is approximately 10. They are also much easier to manage by the owner or an onsite property manager. 2.

Source: reonomy.com

Source: reonomy.com

The definition of a good return on real estate varies by your risk tolerance. This is because the rate is calculated by dividing the total amount of rent received by the total amount invested in a given time period and multiplying it by 100. One of the trickiest factors associated with investing in apartment buildings is evaluating your return on investment. The definition of a good return on real estate varies by your risk tolerance. Buyer S Guide To The Types Of Apartment Buildings.

Source: fixr.com

Source: fixr.com

The lower the cap rate meaning the lower return expected by the investor the higher the value. Many analysts and investors use average returns on the SP 500 as their benchmark meaning any investment that can beat it is a good use of their money. Once we have a pretty strong idea of the local cap rate giving the banks assessment the highest degree of credibility we can calculate the value. And a small apartment investor will typically earn more money per unit each month when compared to larger apartment buildings. 2021 Cost To Build An Apartment Apartment Building Construction Cost.

Source: millionacres.com

Source: millionacres.com

I even bought my first apartment building from a wholesaler and have a 43-unit under contract that was brought to me by an investor who is wholesaling the deal to me. Generally speaking you can expect between a 4-10 cap rate when you purchase an apartment. Or 200 per month. Expenses including the water bill property taxes and insurance totaled 2400 for the year. Guide To Rental Property Investing Basics Millionacres.

Generally speaking you can expect between a 4-10 cap rate when you purchase an apartment. I even bought my first apartment building from a wholesaler and have a 43-unit under contract that was brought to me by an investor who is wholesaling the deal to me. To calculate the propertys. Suppose that were utilizing a cap rate of 10. 2.

Source: fixr.com

Source: fixr.com

An investor can expect between high single-digit and low double-digit cash on cash return lets say 8 to 12. Pros of Investing in an Apartment Building. The lower the cap rate meaning the lower return expected by the investor the higher the value. For example if maintenance property taxes mortgage costs and your down payment. 2021 Cost To Build An Apartment Apartment Building Construction Cost.

Source: fool.com

Source: fool.com

One of the trickiest factors associated with investing in apartment buildings is evaluating your return on investment. If you can get it to generate 160000 it. Your annual return was 9600 12000 2400. An investor can expect between high single-digit and low double-digit cash on cash return lets say 8 to 12. Buying An Apartment Complex Is Easier Than You Think The Motley Fool.

Source: 2ndkitchen.com

Source: 2ndkitchen.com

CAP rates vary from neighborhood to neighborhood. I even bought my first apartment building from a wholesaler and have a 43-unit under contract that was brought to me by an investor who is wholesaling the deal to me. This is because the rate is calculated by dividing the total amount of rent received by the total amount invested in a given time period and multiplying it by 100. Lets take our 60000 Net Operating Income and divide it by the Cap rate to determine the value of the building. What Is A Good Cap Rate For Multifamily Properties 2ndkitchen.

Source: jakeandgino.com

Source: jakeandgino.com

An investor can expect between high single-digit and low double-digit cash on cash return lets say 8 to 12. They are also much easier to manage by the owner or an onsite property manager. Dividing that 55603 of cash flow into the 500000 down payment gives a cash-on-cash return of 111 percent. How to Make Amazing Returns on an Apartment Building. How Much Money Do Apartment Building Owners Make Jake Gino.

Source: investopedia.com

Source: investopedia.com

Smaller apartment buildings offer higher cash-on-cash returns to investors than many larger apartment buildings. To calculate the propertys. Conducts apartment related research encourages the exchange of strategic busi ness information and promotes the desirability of apartment living. The value will increase or decrease based on the cap rate used. An Introduction To Buying A Condominium.

Source: listwithclever.com

Source: listwithclever.com

Or 200 per month. Generally the average rate of return on investment is anything above 15. So the answer is yes it is possible and in this article Im going to outline how to do it. Typically profits above the preferred return are split between the general partners and limited partners. Buying An Apartment Building The Easy Way 12 Step Guide.